|

The region's real estate market appears to have taken a deep breath in June, as overall sales were down 13.4% from May. The numbers reflect seasonal expectations.

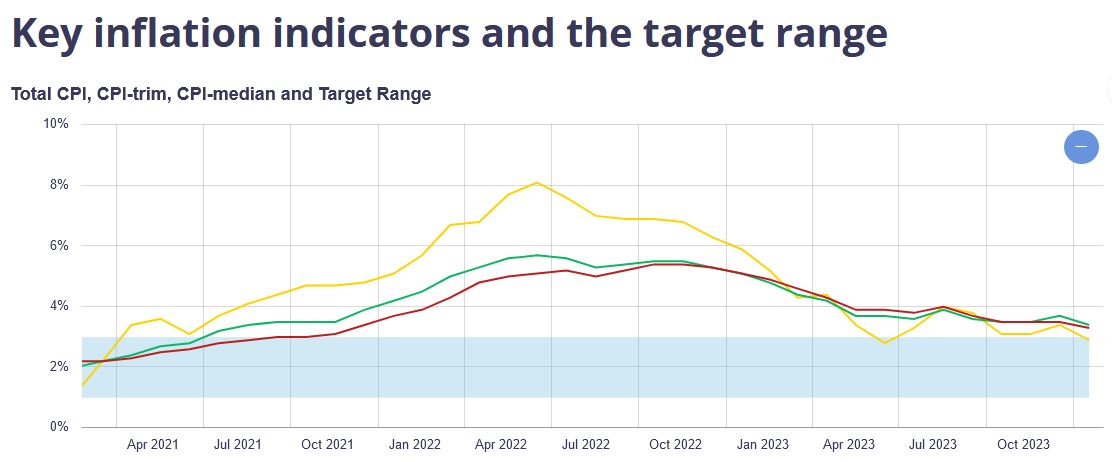

"I think this is good news, as the more stable the market is, the more it supports both buyers and sellers," Victoria Real Estate Board Chair Laurie Lidstone said in a media release. "If we continue to see seasonal norms in our market, the upcoming summer months will be slower and quieter than spring was, as consumer priorities shift to vacations and outdoor pursuits. If the pattern continues, we'll likely see an increase in activity as fall nears." There were 3,460 active listings at the end of June, up 3.7 % from May. June's benchmark value in the Victoria Core was $1,295,500 for a single family home and $567,900 for a condo. Inflation rose 2.9% on a year-over-year basis in May, up from a 2.7% rise in April.

The increase came as a surprise for many economists who are watching for the Consumer Price Index to return to the 2% target, which the Bank of Canada considers to be sustainable inflation. Statistics Canada said May's increase was caused by higher prices for services, specifically cellular services, rent and air fares. "The increase in services inflation is not helpful, especially as wage growth is elevated. The risk of a strong rebound in the housing market hasn’t materialized yet, but slowing shelter inflation is welcome news," Canadian Chamber Senior Economist Andrew DiCapua said. "Our consumer spending tracker is showing growth presenting a risk that demand is more robust. Odds of a cut in July are lower and still depend on whether the economy is weaker than the Bank’s recent forecast. Governing Council continues to be heavily data dependent, and this reversal will support their restrictive bias. The Bank will want to take a slow and measured approach, especially with inflation accelerating." The Consumer Price Index for June will be released on July 16, ahead of the next interest rate decision on July 24. Canada's economy made a significant shift last month when the Bank of Canada dropped its interest rate for the first time in four years. Now the Bank's governor is saying he and his central bank peers are navigating a new world.

"We’ve also learned some lessons from the post-pandemic inflation, and we will take these to heart," Tiff Macklem told the International Economic Forum of the Americas on June 12. "But the challenges of the future are rarely the same as those of the past. Supply shocks are more likely in the future. New technologies not only have the potential to increase prosperity but also to disrupt. Interest rates may be easing in many economies, but global interest rates are unlikely to return to pre-pandemic levels. The new normal won’t be the old normal. And if we’re not going back, we’ll all need to adjust." Macklem said supply-side economics, inflation as a common enemy and public trust in the banking system are the biggest lessons learned from the past four years. The Bank's next interest rate announcement is set for July 24. Finally. The weather forecast calls for clear skies and warm days this weekend, the HarbourCats have fireworks planned for Saturday night, after their homeopener on Friday — and the Bank of Canada has taken the initial step to reduce the pain of high interest rates.

For the first time since March 2020, the bank lowered its overnight rate. It's now 4.75%, down from 5%, and expected to drop further in the months ahead. "We've been hearing from members who have felt squeezed by the high rates and what that has meant for their customers who have been feeling squeezed themselves," Chamber CEO Bruce Williams said. "No one wants inflation to return, but we're hopeful this move by the bank marks a return to stability needed for businesses to make those investments that help them grow." The bank's governor, Tiff Macklem, was careful not to promise future cuts, but the Conference Board of Canada stated that conditions are right for the rate to fall further. On Saturday, the province's minimum wage increases from $16.75 to $17.40 an hour.

BC continues to have the highest minimum wage among Canadian provinces. "First, we acknowledge that times are challenging — especially for people trying to make a living while earning minimum wage," Chamber CEO Bruce Williams said, noting that many Chamber members already pay higher than minimum wages. However, increasing the cost for employers and businesses will result in higher costs for goods and services. Businesses set prices based on their costs, including payroll. Linking minimum wage to the outsized inflation of recent years is out of step with today's economy and the pressures faced by recovering businesses. "Increasing minimum wage by almost 4% creates a more challenging environment for businesses in BC, especially compared to Alberta where the minimum wage is now $2.40 less," Williams said. "It doesn’t take a rocket scientist to see that adding expenses is not the way to attract employers to our province." And with fewer employers, there is less competition for employees — driving down their earning potential. "No one wins when businesses leave because they can’t afford to operate here," Williams said. "The best thing government can do is reduce the cost for entrepreneurs and the private sector. We want the economy to grow and lift everyone by enabling employers to hire more people and pay them competitive wages." Make sure to circle June 5 on your calendar after Statistics Canada's latest figures show inflation continues to slow down. The Consumer Price Index for April rose by 2.7%, compared to 2.9% in March. If you take gas prices out of the equation, the CPI was actually down to 2.5% in April.

"April’s CPI report adds weight to the thesis that interest rate cuts will begin in June," the Conference Board of Canada said about the Bank of Canada's next interest rate announcement on June 5. "On balance, signs suggest that June remains 'within the realm of possibilities' for the Bank’s first rate cut." Sticky inflation and high interest rates discourage investment, slowing the economy and adding to uncertainty. It's been the hot-button topic for so long, it's easy to forget just how much inflation has forever changed the cost of household budgeting.

An online tool can help track exactly how much individual goods have changed in price. The Average Retail Food Prices Data Visualization Tool is helpful to show the price increase or decrease for 105 typical grocery items. For example, the cost for one kilogram of chicken breast in BC was $18.18 in March compared to $16.71 a year earlier. Meanwhile, a 454 gram block of butter was $6.08 in March — down from $6.45 in the same month in 2023. In BC, the item that saw the largest increase in price over the last year is infant formula, which is up 24% year over year. It's not everyday that your breakfast conversation includes a candid discussion with BC's Premier about the major challenges facing business in Greater Victoria.

That was the experience yesterday for 300 people at the Victoria Conference Centre as they were able to nourish their bodies while feeding their minds. After speaking about the government's plans to support the private sector and grow BC's economy, Premier David Eby engaged in a lively discussion with Chamber CEO Bruce Williams about topics submitted by Chamber members. Community safety is top of mind for many people, and the Premier acknowledged the province is trying to find a solution for challenges facing governments around the world. The recent move to ban drug use in public spaces is an example of how government reversed course on a policy that wasn't working as intended. The long-term solution is complex, with Eby noting that a continuum of care is required for people experiencing homelessness rooted in mental health or addiction. Other topics included the province's plan to avoid disruptions to ferry sailings this summer — something that happened with alarming frequency last year — and how the province can reduce obstacles for builders so that they can increase housing supply. "The morning flew by and we could have easily kept talking all day," Chamber CEO Bruce Williams said. "I'm grateful for the Premier's time and for everyone who chose to enjoy breakfast with us. We'll keep the dialogue going between business and government and work together to find innovative solutions to the challenges facing our community." The slight increase to inflation reported yesterday is not outside the range that could jeopardize an anticipated interest rate cut in June.

Statistics Canada reported yesterday that the Consumer Price Index rose to 2.9% in March — up from 2.8% in February. Gas prices were the biggest reason for the rise. Without those fuel costs, March's inflation actually slowed from the previous month. "Many inflation indicators are trending in the right direction and interest rate cuts are still on the table for the Bank of Canada’s interest rate announcement in June," the Conference Board of Canada stated, adding that getting to 2% inflation target could take awhile. Many employers are forecasting wage growth and consumers still see prices rising in the months ahead. "While there is still one more CPI release to come before the Bank's next policy decision, (yesterday's) data keeps us on track to see a first rate cut at that June meeting," CIBC Executive Director of Economics Andrew Grantham said. Hurry up and wait. That seems to be the message from the Bank of Canada today, after it held its target for the overnight rate at 5%. The Bank's Governing Council would like to see evidence that inflation will continue to trend down before announcing cuts. Optimism remains that there will be enough evidence by the time the Bank makes its next rate announcement on June 5.

"We currently forecast a first interest rate cut in June," CIBC Executive Director of Economics Andrew Grantham said in a media release. "To steal a line from (Bank of Canada) Governor Tiff Macklem's press conference today, that outlook still appears to be within the realm of possibility." The Bank of Canada released its Business Outlook Survey as well as its Survey of Consumer Expectations this week.

The findings show that business conditions have improved in the first quarter of 2024. It's the first positive change in almost two years. The survey also found that fewer Canadian businesses are planning for a recession this year. There was more good news as labour constraints and supply chain challenges are less of a problem. However, businesses reported facing new burdens from taxes and red tape. Consumers said inflation and interest rates are affecting their household budgets, though there was less pessimism about the future of the economy and job prospects. Greater Victoria's real estate industry appears to be back in season.

"We have more inventory for consumers to consider when compared with recent years. This additional inventory improves both buyer and seller confidence as it means people have more options and more reassurance that they are going to be able to find their new home," Victoria Real Estate Board Chair Laurie Lidstone said in a media release. "As people buy and move, more properties are added to the available inventory, which supports a much healthier market. Supply really is key, and looking to the future we need to ensure that focus continues on the creation of new homes of all types and price points." VREB reported 2,647 active listings at the end of March 2024 — up 12% from February and 34.4% March 2023. In the core area of our region, the benchmark value for a single family home in March 2024 was $1,279,300, up from February's value of $1,247,400. The benchmark value for a condominium in March 2024 was $567,300, up from $557,000 in February. Now more than ever it is vital for governments to reduce the burden on business to spur the investments needed to increase productivity. Doing so will inoculate our economy against runaway inflation, said the Bank of Canada's Senior Deputy Governor Carolyn Rogers on March 26. "An economy with low productivity can grow only so quickly before inflation sets in. But an economy with strong productivity can have faster growth, more jobs and higher wages with less risk of inflation," Rogers said. "That’s why I want to talk about Canada’s long-standing, poor record on productivity and show you just how big the problem is. You’ve seen those signs that say, 'In emergency, break glass.' Well, it’s time to break the glass." Rogers said there was a spark of hope during the pandemic as business showed resourcefulness and ingenuity. However, unlike what is happening in the U.S., Canadian firms reverted to low levels of productivity from before the pandemic. To increase productivity, businesses and their employees need three things:

"Weak investment has been a problem in Canada for a long time. You can go back 50 years and find a persistent gap between the level of capital spending per worker by Canadian firms and the level spent by their US counterparts," Rogers said, noting it's harder for new businesses to compete and too much red tape reduces the incentive to change and evolve. "Higher productivity should be everyone’s goal because it’s how we build a better economy for everyone," she said. "When a business gives workers better tools and better training, those workers can produce more. That, in turn, means more revenue for the business, which allows it to absorb rising costs, including higher wages, without having to raise prices." For the second month in a row, Canada's inflation rate was lower than expected. That's good news for everyone feeling the pinch of higher costs.

"The Consumer Price Index rose 2.8% on a year-over-year basis in February, down from 2.9% in January. Notable contributors to the deceleration included the indexes for cellular services, food purchased from stores, and Internet access services," Statistics Canada said in its media release. Offsetting the deceleration was a year-over-year increase in gas prices, which rose 0.8% in February. "It’s great to see headline inflation move further within the target range, and core inflation continuing its downward trend. We could see that the market was expecting a slightly higher inflation print, due to gasoline prices rising in February, but grocery store prices have slowed, and short-run core momentum measures are tracking around two percent. That’s going to be welcome news for households," Canadian Chamber of Commerce Senior Economist Andrew DiCapua said, adding the Bank of Canada will see the latest figure as a signal its fight against inflation is working. "But we shouldn’t expect any moves from the Bank until June. With two more inflation updates, updated surveys on expectations, and a Federal budget, the Bank will want to see the data and build a case for any changes before they present anything to Canadians." The Bank of Canada did as expected this morning and held steady on its overnight interest rate.

"Economic growth has remained weak, and inflation has eased further as higher interest rates restrain demand and relieve price pressures," Bank of Canada Governor Tiff Macklem said at the morning media conference. "But with inflation still close to 3% and underlying inflationary pressures persisting, the assessment of Governing Council is that we need to give higher rates more time to do their work. With that in mind, Governing Council decided to maintain the policy interest rate at 5%. We are also continuing our policy of quantitative tightening." The Bank cited its reasons for holding its rate as slow economic growth around the world, including in the United States, the increasing cost of oil, and inflation remaining higher than the target range of 2%. "Governing Council wants to see further and sustained easing in core inflation and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour," the Bank's statement said. The Bank's next scheduled interest rate announcement is April 10. The provincial government is raising the minimum wage by 65 cents, effective June 1.

The increase means the lowest an employee can be paid is $17.40 per hour, up from $16.75. The rate reflects annual inflation in the province. "We know many Chamber members already pay more than the minimum, but inflating the base rate inevitably increases the wages of other employees, which adds further costs during a time of economic uncertainty," Chamber CEO Bruce Williams said. "Businesses are already working hard to find and keep good workers, and we understand that increasing wages is part of that. And while we appreciate that the government is giving businesses time to adjust and offering future certainty by tying the increase to inflation, we think there are better ways government can lower the cost of living to make our province more affordable." The seemingly endless not-great news about inflation and interest rates took a pleasant turn this week. On Tuesday, Statistics Canada revealed that the Consumer Price Index rose 2.9% in January.

That's lower than economists expected, and within the target range that the Bank of Canada uses to indicate a balanced economy. As a comparison, inflation was 3.4% in December. "Inflation is now in the target range, which is good news for the Bank of Canada. But the Bank is also acutely aware of the stickiness of core measures and the impact of elevated shelter prices," Canadian Chamber Senior Economist Andrew DiCapua said. However, despite the surprise drop in inflation, the Bank is still expected to hold its interest rate at 5% until late spring. "The unexpectedly large declines in airline fares and clothing prices may be a sign of weakness in consumer spending, but could also partly reflect some data volatility," stated an Economics Report from CIBC. "However, even allowing for a partial rebound, inflation in Q1 is still tracking below the Bank of Canada's MPR forecast (2.9% vs 3.2%). So even with GDP growth running somewhat stronger than they expected, we still anticipate that interest rate cuts will start in June." Understanding economic trends is invaluable to helping businesses plan for the future. The Chamber relies on a number of sources for information and analysis, including our national network.

On Tuesday, Canadian Chamber Chief Economist Stephen Tapp provided members of The Chamber's Public Policy and Advocacy Committee with his insights. "We're fortunate to have access to a deep pool of experts who help us make effective use of our advocacy efforts," Chamber CEO Bruce Williams said. "The Greater Victoria Chamber of Commerce has a long history as Western Canada's first chamber and we continue to play an active role with the Canadian Chamber." Tapp spoke about the state of the economy and expectations for interest rate cuts, using the latest numbers from the Business Data Lab. Click the image to view Tapp's presentation. For information on joining a Chamber committee, go to victoriachamber.ca/committees for contact info. A new report offers insight into how shifting consumer behaviours are changing the way small businesses operate post pandemic.

On Monday, the Canadian Chamber of Commerce’s Business Data Lab released A Portrait of Small Business in Canada: Adaption, Agility, All At Once. The findings shed light on how businesses can thrive despite the rising cost of doing business, the highest borrowing costs in over two decades and the increased pandemic debt loads. Examples for businesses include investing in technology, staying agile to embrace shifting trends and working with their chamber to call for less red tape from government. The report also explores the unique realities, challenges and opportunities for small businesses owned by women, persons with disabilities, members of the LGBTQ2s+ community, immigrants to Canada, Indigenous peoples and visible minorities. As expected, the Bank of Canada left its overnight rate at 5% — though there were suggestions in today's announcement that rates could come down eventually.

The bank remains concerned about ongoing high inflation and forecasts core costs to continue increasing by 3% in 2024, before easing to the target rate of 2% in 2025. Among the metrics the bank is watching are wages, which continue rising around 4% to 5% annually, even as job vacancies are being created at a slower rate than population growth. "Global economic growth continues to slow, with inflation easing gradually across most economies. While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment," the bank said. "In Canada, the economy has stalled since the middle of 2023 and growth will likely remain close to zero through the first quarter of 2024. Consumers have pulled back their spending in response to higher prices and interest rates, and business investment has contracted." The Consumer Price Index rose 3.4% on a year-over-year basis in December, following a 3.1% increase in November. The increase adds a little more uncertainty to what the Bank of Canada will do at its next interest rate announcement on Jan. 25.

Some of the reasons for the acceleration in inflation include higher costs for airfares, fuel oil, passenger vehicles and rent. Prices for food rose 4.7% year over year in December. Greater Victoria's unemployment rate of 4.1% in December was unchanged from November 2023. According to Statistics Canada, the region's population increased to 367,400 from 366,700 over the month.

Our local labour force was also up with 244,700 people in December compared to 242,900 in November. The stats reflect the national trend as employment growth slowed in the second half of 2023 with population growth outpacing the number of new jobs added to the economy. "The momentum in the labour market is weakening alongside the fastest population growth in more than 50 years," Canadian Chamber Senior Economist Andrew DiCapua stated in a news release. "With essentially flat job growth in December, the Canadian labour market ends 2023 with over 5% wage growth and an unemployment rate steady at 5.8%. Although hours worked rose for the month, this will be a drag on fourth quarter GDP as we round out the year. This signals to the Bank of Canada that the guise of a strong labour market is cracking amid strong labour force gains. With wages accelerating, the Bank was wise to not celebrate at their last meeting, possibly delaying their intentions to begin rate cuts." Property owners, check your mail. You can expect to receive your 2024 assessment notice any day now. The assessments reflect market value as of July 1, 2023, and can also be viewed at bcassessment.ca.

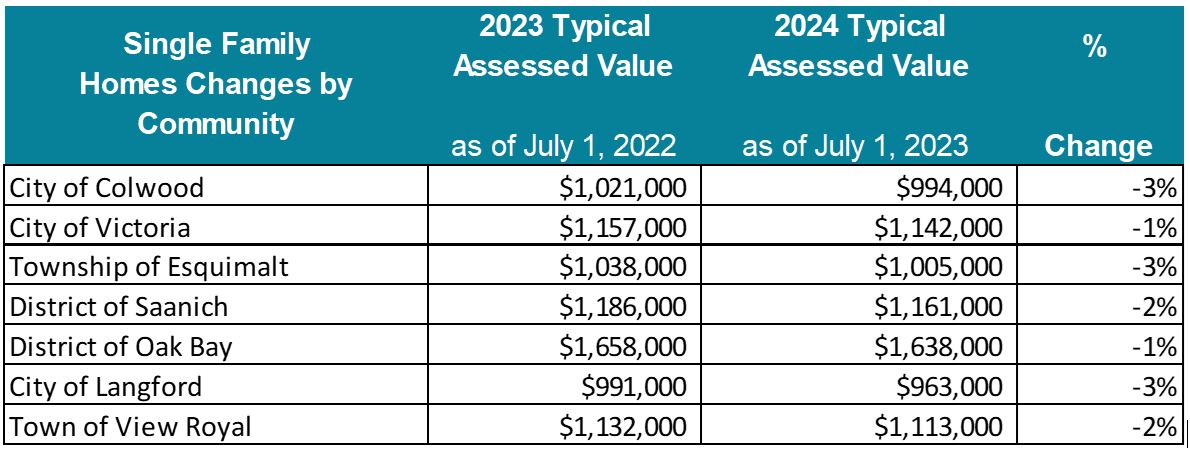

“For 2024, most homeowners can expect generally flat values including a mix of small decreases or only modest increases, reflecting the softening real estate market," Vancouver Island Deputy Assessor Matthew Butterfield stated in a news release. "Homeowners throughout Vancouver Island will generally see somewhere in the range of -5% to +5% change in assessment values." Total assessments for Vancouver Island properties were more than $386 billion this year, up about $1 billion from 2023. Assessments are not directly connected to any change in your property taxes, as those are set according to the needs of the municipality your property is in. However, if your property's value changed relative to other properties, you might see a change in your tax bill. In Greater Victoria, every municipality experienced a drop in the assessed value of a "typical home," including the examples below: Never bet against the ingenuity of small business, especially when entrepreneurs and employers work together.

The Chamber was among 240 organizations that sounded the alarm last year about the looming Jan. 19 deadline for the Canada Emergency Business Account. The federal government has committed to reviewing, on a case by case basis, the circumstances of businesses still struggling to pay back their loan. However, the Canadian Chamber of Commerce reports that more than three-quarters of businesses that accessed the loan were able to repay in time. Additionally, a company specializing in small business financing recently announced it has secured $300 million to help businesses that need to refinance their CEBA loans. BC-based Merchant Growth is working with financial advisor Raymond James to help businesses that need to refinance their CEBA loans. "Help is available for businesses who continue to be impacted by the effects of the pandemic and the rise in inflation and interest rates," Chamber CEO Bruce Williams said. "If you're ever facing a situation where you are not sure what to do, please know that The Chamber is here for you and we will do everything in our power to help." The New Year marked the start of new rules for Canada's Pension Plan. The change introduces a second earnings ceiling for middle-income earners making more than $73,200.

For employers, this means changes to the amount they need to withhold for eligible employees. And for the self-employed, the changes impact CPP contributions based on net income. The federal government says the enhancement will increase the maximum CPP retirement pension by about 50% for people who have recently entered the workforce. |

Categories

All

|

Copyright © 2021 Greater Victoria Chamber of Commerce. All rights reserved.

#100 – 852 Fort St., Victoria, BC V8W 1H8, Canada | Phone: (250) 383-7191

[email protected] | Site Map

#100 – 852 Fort St., Victoria, BC V8W 1H8, Canada | Phone: (250) 383-7191

[email protected] | Site Map

Notice a typo or broken link? Please let us know so we can fix it ASAP. Email [email protected]