|

Feeling safe at home and at work is a fundamental requirement for good business and great community. The Chamber supports initiatives such as two recent announcements about investments in housing and support programs to help people reintegrate into society.

Access Hub for Street Community The City of Victoria has agreed to provide up to $1.8 million for the operations of a new access hub facility at 2155 Dowler Pl. that reduces the risk and impacts of homelessness. Funds come from the Financial Stability Reserve, which can be used in situations related to public safety. The 5,264 square-foot property will include community space for people to have immediate access to supports aimed at breaking the cycle of homelessness. The property will be fenced and security will be on site to address any impacts on neighbouring properties Transitional Housing for Fresh Start On Tuesday, the province announced plans for 28 transitional homes with supports for people leaving the correctional system. Located at 736 Princess Ave., the six-storey building will be owned and operated by the John Howard Society of Victoria, which is dedicated to helping people with programs and services focused on employment, housing, mentorship and restorative justice. The building will be the John Howard Society’s new headquarters. The upper floors of the building will have 28 studio apartments, each with a private washroom and kitchenette. On Monday, the federal government announced $530 million to help Canadian municipalities adapt to the changing climate. The money will help cities and towns prepare for flooding, heat domes and other impacts on residents and infrastruture caused by weather events.

The Federation of Canadian Municipalities will administer the fund, which is a fraction of the $10 billion the FCM estimated is needed. "In all, there are three funding streams that will provide substantial support for municipalities to carry out climate adaptation projects. In addition to support for climate adaptation planning, municipalities can apply for up to $1 million for implementation projects and up to $70,000 for feasibility studies," the media release said. "Municipalities that have completed climate adaptation plans and/or risk assessments are eligible to apply. The deadline for applications is Aug. 14, 2024." April's unemployment rate dipped to 4.5% in Greater Victoria, according to Statistics Canada's latest figures.

That's down from 4.8% in March. The region's labour force grew to 244,000 in April compared to 242,000 in March. Nationally, the unemployment rate was 6.1% in April, unchanged from March after dropping consecutively for six months previously. Provincially, the rate was 5% in April, with 23,400 jobs added over the month. Greater Victoria had the lowest unemployment rate in BC in April, and the fifth lowest among all Canadian Census Metropolitan Areas. The federal government has updated its Letter of Requirements to support BC's exemption of hard drugs. The move is the latest twist in what was intended to be a three-year pilot project decriminalizing highly addictive drugs.

The provincial government asked to end the pilot and go back to prohibiting drug use in public spaces. BC Premier David Eby told Chamber members last week that his government decided to reverse course on a policy that wasn't working as intended. “Keeping people safe is our highest priority. While we are caring and compassionate for those struggling with addiction, we do not accept street disorder that makes communities feel unsafe,” Premier Eby said in a media release. “We’re taking action to make sure police have the tools they need to ensure safe and comfortable communities for everyone as we expand treatment options so people can stay alive and get better.” More spending and more taxes have many business groups concerned about the future after the federal government released its ambitious 2024 Budget yesterday.

"Canada must end the cycle of tax and spend politics," Canadian Chamber of Commerce Senior Director of Fiscal and Financial Services Policy Jessica Brandon-Jepp said. "Fueling economic growth is the key to improving quality of life and affordability for Canadians." The national chamber network opposes any measure that increases costs for businesses currently experiencing economic headwinds. We also will work with our members to understand how the increase to capital gains tax will impact business. "(The) budget contains few surprises. Most of the major new spending was announced by the government over the last few weeks, and the government’s projections for the deficit are largely in line with previous predictions," Canadian Chamber CEO Perrin Beatty said. "Our lagging productivity and stalled GDP growth means Canadians are becoming collectively poorer and working harder to just remain where they are today." New taxes will cover about $18 billion with about $57 billion in added spending:

Using available land on military bases for direly needed homes for military personnel can help solve Canada's housing crunch.

The Chamber is currently crafting a policy resolution on this solution for our national network to take to the federal government. This week, we heard good news from the feds. The defence policy update titled Our North, Strong and Free includes almost $300 million for Canadian Armed Forces Housing over 20 years. "Chamber members tell us one of the biggest hurdles for finding and keeping workers is the cost of housing in Greater Victoria," Chamber CEO Bruce Williams said. "We have thousands of Armed Forces personnel in our region, and providing more, quality housing on CFB Esquimalt land will free up homes off base for other workers." The update announced a total of $8.1 billion over five years and $73 billion over the next two decades to bring Canada closer to its NATO commitment. The jump at the pumps was no April Fool's prank as the tax on gasoline increased on April 1 to $0.17 cents per litre from $0.14 per litre.

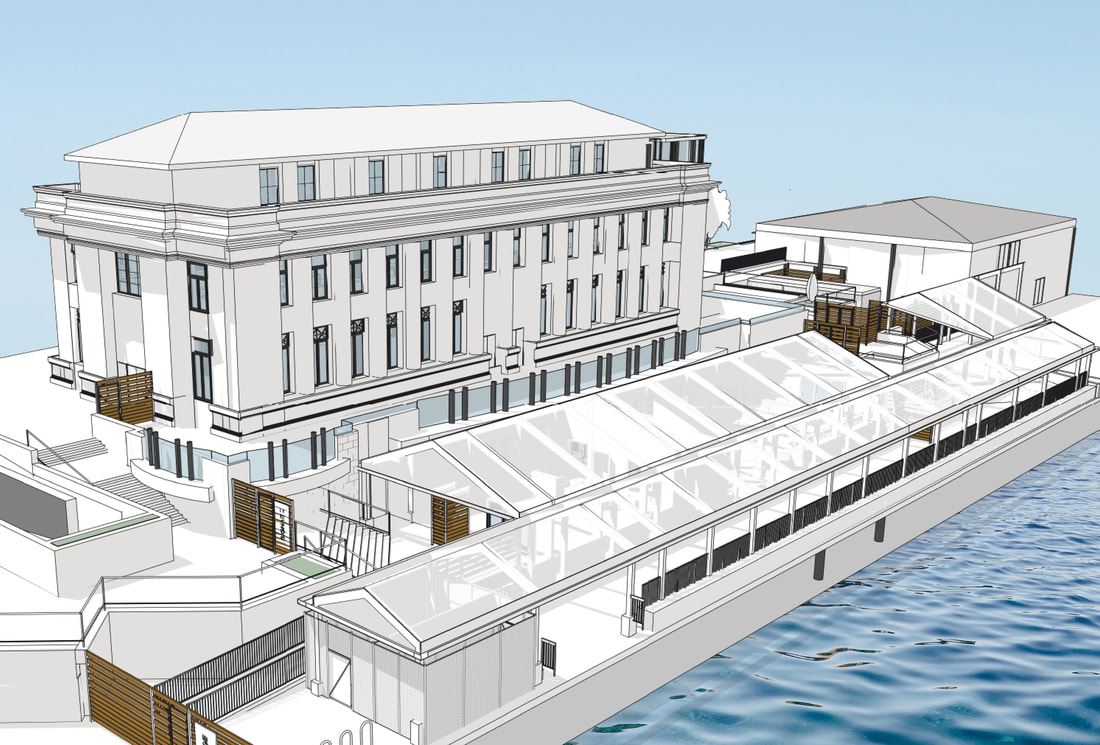

BC has had a carbon tax since 2008. The provincial tax is separate from the federal tax implemented in many other provinces. As such, the rebates available to Canadians in those provinces are not the same as those offered here. In BC, carbon tax rebates are income tested and only available to those earning less than $61,465 per year. "The Chamber supports climate action leadership, and the idea of a carbon tax has its merits," Chamber CEO Bruce Williams said. "What needs further examination is how the revenue from this tax is being used. We know innovation led by business is key to finding climate change solutions and that requires reducing the burden on the private sector." Canada's Finance Minister and Deputy Prime Minister Chrystia Freeland made a surprise visit to Victoria on Monday for a meeting with BC Premier David Eby. With the federal budget coming on April 16, Freeland was in town to promote her government's investment in housing across Canada. "For me, it's actually pretty simple," Freeland said at a media event ahead of her meeting with Eby. "It's housing, housing, housing. Supply, supply, supply, affordability, a strong economic plan that delivers great jobs and a real focus on younger Canadians." Freeland stated $34 million in federal funding has helped create homes in Greater Victoria — something the Greater Victoria chamber continues to call for to help our region meet the demand at the root of housing affordability. Freeland highlighted Sawyer Block on Fort Street, which has 60 rental apartments, and a project in Cook Street Village that helped build 47 rental apartments. "Through the Apartment Construction Loan Program, we will also be offering low-cost loans to post-secondary institutions — like the University of Victoria ... so that they can build more student housing on- and off-campus," Freeland said in her presentation. "This will help more students to find housing they can afford close to where they study, and at the same time, it will mean that there are more homes available for those who live in those same communities year-round." Adding on-campus housing is another long-standing chamber advocacy priority, Chamber CEO Bruce Williams said. "This is a big win for our advocacy work. We know that one of the biggest challenges for building homes in Greater Victoria is our land constraints," Williams said. "Post-secondaries have the space. They need the right financing to make housing work and this is part of that solution." Contracts have been announced for construction on the Belleville Terminal redevelopment project, which will give our region a secure, modern pre-clearance terminal to act as an international gateway for goods, services and passengers.

Work will begin immediately on a temporary terminal, with estimated completion in fall 2024. Offsite work on a new wharf will begin soon near Cowichan Bay, before moving to the Inner Harbour this summer. The project is also advancing toward the Phase II permanent upgrades to the terminal. "As a gateway to Canada, to British Columbia and to our region, Belleville Terminal serves as a vital connection point for trade and tourism. The Greater Victoria Chamber of Commerce has made the case for modernization for more than 20 years," Chamber CEO Bruce Williams said when the province announced the redevelopment would begin this year. "I'm encouraged to see progress being made now. There is an urgency to ensure Belleville can continue to serve as an important border crossing and point of entry, and the time is now for this project to happen." During construction, pedestrians won't have access to the causeway behind the Steamship building. There will be no impact to Clipper and Coho ferry sailings. The upgrade brings the terminal into compliance with the Canada-U.S. Land, Rail, Marine and Air Transport Pre-clearance Agreement, and will streamline travel by allowing passengers to complete the customs and immigration process in Victoria prior to disembarking in the US. Visitors spend $174 million annually, generating $268 million in economic output and $155 million in provincial gross domestic product, according to the media release. The project is expected to be complete in time for the 2028 tourism season, with a budget of $303.9 million and a $41.6-million federal contribution. A special roundtable held today gave Chamber members doing business in the US a chance to talk trade directly with federal Minister of Export Promotion, International Trade and Economic Development Mary Ng.

During the face-to-face meeting, the Minister said that Canadian businesses are all part of a Team Canada approach needed to remind Americans that Canadians are key customers and important allies. “The US is our closest friend and biggest trading partner. No one knows that better than Greater Victoria businesses — the US is BC’s biggest customer, importing more than $30 million in goods and services annually," Minister Ng told The Chamber after the meeting. "Through our Team Canada engagement, we are working together at all levels to make sure Canada and our relationship with the US stays centered in the minds of Americans. That effort needs the help of our businesses, like the members of the Greater Victoria Chamber of Commerce, to help highlight the incredible strength of this partnership. At the heart of this work is advancing opportunities for Canadian workers, businesses, and communities across the country and right here in BC.” Among the many questions brought up during the discussion were challenges with the development of innovative mining equipment. Canadian firms face unfair competition from some overseas companies that don't have the same strict environmental and labour standards. Minister Ng noted that the Canada United States Mexico Agreement can give BC companies an edge because it includes prohibitions against trade that involves forced labour or bad environmental practices. The Minister also heard from Chamber members who wanted help making the connections needed to get products on US shelves, as well as others asking for a better coordinated national approach to procurement and distribution of goods and services. To share questions or comments with the Minister's team, email [email protected]. Canadians will find out next month whether the federal government is paying attention to the growing calls from business to improve our country's productivity, competitiveness and standard of living.

Federal Finance Minister and Deputy Prime Minister Chrystia Freeland announced today that Budget 2024 will be presented in the House of Commons on April 16. The Canadian Chamber submitted a list of recommendations during budget deliberations that came from business leaders across the country. Many of these are echoed by members of the Greater Victoria Chamber of Commerce. "We need economic growth to be driven by the private sector, and some of the changes that can be done on a federal level are simple — and cost effective — changes to red tape," Chamber CEO Bruce Williams said. "We know innovation is driven by business and it's time for government to focus on policies that encourage investment in the infrastructure needed to build a sustainable and resilient economy." Among the recommendations are to:

Fentanyl abuse is wreaking havoc in many cities, including Greater Victoria. The Chamber advocates for safe communities for all, though there is no simple solution to addiction and the health challenges that are at the root of the issue.

Earlier today, BC's Minister of Mental Health and Addictions issued a statement marking the one-year anniversary of drug decriminalization in BC. “This past year has seen a concerning increase in toxic drug deaths in provinces across the country, and British Columbia was no exception. Ending this measure will not save a single life. As the toxicity of illicit street drugs continues to increase, more people are at serious risk. There is no single solution to this complex and unrelenting public-health emergency, and we will continue to use every tool available to save lives and connect people to care," Minister Jennifer Whiteside said, promising to invest in early intervention and prevention services, expanded access to harm-reduction supports, increased medication-assisted treatments, and expanded treatment and recovery services. The statement comes in the wake of recent comments by former Chief Coroner Lisa Lapointe, who criticized the government for not providing better access to help while making the case for an ongoing pragmatic approach to decriminalization. Lapointe spoke with CBC Radio about her experience and what she believes is needed to address this crisis. The Chamber continues to call for better access to treatment and care, and applauds the recent funding for Our Place Society's New Roads Recovery Community Centre. The province is providing $9 million to fund 20 beds for women to try and replicate the success the men's program has had at the View Royal facility. The Canadian Chamber has sent an open letter to the Prime Minister's Office calling for the government to focus its foreign policy on results rather than "good feelings."

"It is clear that we can no longer take for granted the stable and peaceful international conditions that Canada helped to shape following the Second World War. This moment calls for a sober assessment of our international priorities and a recalibration of how we engage with other nations," states the letter from Canadian Chamber President and CEO Perrin Beatty. The Chamber is concerned about Canada's place in a world that has profoundly changed over the last few years, "with the international order being challenged and undermined on many fronts." The letter notes that, other than the Indo-Pacific Strategy, Canadian foreign policy has become reactive and unfocused, "signaling that we have too often concentrated our efforts on policies designed to produce good feelings instead of on those that will produce good results." The Canadian Chamber has proposed three ways to improve Canada's international standing. The first is to fulfill our trading potential as a reliable global supplier. The second is showing a serious commitment to economic and security commitments that Canada helped establish after the Second World War. And the third is recognizing the value of good relationships with our North American neighbours by promoting Canada's importance in those countries. "The Canadian Chamber of Commerce is a longstanding advocate of unlocking Canada’s international potential, and we support our businesses in trade advocacy, navigating global markets and representing Canada at key multilateral fora," the letter concludes. "The Canadian business community recognizes that our collective long-term prosperity is closely tied to how we engage with the world." The New Year marked the start of new rules for Canada's Pension Plan. The change introduces a second earnings ceiling for middle-income earners making more than $73,200.

For employers, this means changes to the amount they need to withhold for eligible employees. And for the self-employed, the changes impact CPP contributions based on net income. The federal government says the enhancement will increase the maximum CPP retirement pension by about 50% for people who have recently entered the workforce. A report by Deloitte Canada released this week offers an insightful look into how housing plays a direct role in our economic productivity. Specifically, the report examines housing "not entirely governed by the laws of supply and demand."

The report calls this "community housing," which includes co-ops, non-market homes, social housing and lower-cost market rentals. Among the findings is that housing affordability in Canada is at its lowest point since 1990. Canada is also facing a problem with lagging productivity and we need to find ways to boost output without causing inflation to rise. Through its research, Deloitte found adding community housing to a region supports economic development and productivity. Community housing had been a much more prevalent part of home construction until the 1980s. After several decades of little investment in this type of housing, more units are now being built — though they still represent a relatively small share of total stock being added. The Canadian Mortgage and Housing Corporation recently reported that Canada needs 3.5 million new homes by 2030 to achieve affordability. Deloitte's report concluded that government investment in community housing will help meet this demand and boost our economy's potential output growth. "If Canada’s community housing units as a share of total housing units were to increase from 2023 Q2’s level of 5.5% to 7% by 2030 this would require an increase of 371,600 units in Canada’s total community housing net stock," Deloitte's report stated. For BC, this would equate to 50,870 additional units by 2030 — a 42% increase from 2023 levels. Doing so would increase provincial productivity by up to 9.3% adding $25 billion to BC's GDP. Watching inflation numbers is a bit like going fishing. Anticipation builds as we approach the latest monthly update on the Consumer Price Index from Statistics Canada. And much like the feeling when you lower your rod into the water, even a subtle sign can feel exciting. The latest nibble to delight inflation watchers happened Tuesday as CPI came in at 3.1% for October. That marks a significant deceleration from 3.8% in September.

Lower gas prices helped lower inflation last month, while mortgage costs and food prices are keeping it higher than the Bank of Canada's target rate of 2%. The Bank makes its next interest rate announcement on Dec. 6, with expectations that it will hold steady before potentially starting to lower rates next spring. The federal government's much-anticipated fall economic statement was released yesterday, Nov. 21. There were few surprises from a government that has little room left to spend and a tepid economic environment to work with.

"(The federal government) followed a highly stimulative fiscal framework following the pandemic, from which they had not significantly withdrawn as the economy hit its capacity in the past two years. That forced the Bank of Canada to apply even more restrictive monetary policy to offset the effects of the government’s stimulative impulses, akin to pushing the brake and gas pedals at the same time," the Conference Board of Canada said in its analysis. "Let us hope that the two policymaking bodies can begin to row in the same direction in the future as inflation pressures subside. Interest rates will likely be coming down next year, but negative federal fiscal balances also need to be pushed back toward neutral territory at a greater pace." There are some positives for business as the statement included proposals to ensure open access to markets, fewer taxes on mental health support and relief for mortgage holders at risk from higher interest rates. The government also earmarked $15 billion for rental home construction, though there are no details on how the funds will deliver 30,000 new units as promised. Consultations have begun on the 2024 federal budget and The Chamber will work with our national network to give members a voice in the process. Advocacy efforts to extend the CEBA repayment deadline appear to be working. The Chamber and our national network along with many other business organizations are calling on the federal government to give businesses more time to repay without losing the forgivable portion of their CEBA loans.

Chamber Chair Kris Wirk said in a September media release that “The reality facing many small businesses — especially those in hospitality, tourism and retail — is that they have a viable path to making a full recovery but it’s going to take longer than expected.” This week, federal Small Business Minister Rechie Valdez told BNN Bloomberg that she's heard the message and seen the struggles facing businesses firsthand. She promised to go back to government to do more. Under the Canada Emergency Benefits Account, businesses that needed help during the pandemic were offered loans of up to $60,000. Part of the appeal was that one third of the loan would be forgiven if paid by the deadline, which was extended from Dec. 31 to Jan. 18. And while 2024 seemed like a long way off in the depths of the pandemic, unforeseen challenges with inflation and interest rates has kept many businesses from fully recovering. Chamber member Megan Johns, owner of The Green Kiss explained the situation succinctly to CBC, noting that she was on schedule with her CEBA loan until operating costs began to soar faster than her business could grow. "Margins are getting smaller and smaller and smaller due to the rising costs across the board," Johns said. "Every aspect of the business has become more challenging and it is more challenging now than it was in 2020 so far." Last week's announcement by the federal government that it was working with Canada's largest grocers to stabilize food prices is a start. But it will take more than blaming business to bring inflation back to its target rate of 2%.

On Oct. 5, the Minister of Innovation, Science and Industry said grocery store chains were committed to price stability. The government also moved to strengthen the voice of consumers, increase industry transparency and improve available data on Canada's agri-food supply chain. Yesterday, an industry association representing grocers called for a pause on increases to the regulated price of milk. The Canadian Dairy Commission sets changes to the cost of milk that take effect every February. "If government is serious about reducing the price of groceries it needs to look at cutting costs before products get to retailers," Chamber CEO Bruce Williams said. "Government contributes to cost increases when it adds regulatory burdens and increases taxes. We can't expect farmers and other producers to pay for these extra costs which get passed along to the consumer." In Greater Victoria, The Chamber serves as the voice of business by amplifying what we hear from our members. We can then further raise the volume by working with our national network to include the questions and concerns of more than 200,000 businesses across Canada.

A recent example is the 2024 pre-budget recommendations submitted by the Canadian Chamber to the federal government. The submission calls for for investment in trade-enhancing infrastructure, easing the burden of doing business, facilitating the transition to net-zero, enabling an innovative economy, attracting and retaining talent and taking a lead role in life sciences. To learn more about the work done by The Chamber's Public Policy and Advocacy committee, contact [email protected]. The Chamber is calling on the federal government to give businesses who needed help during the pandemic more time to repay their Canada Emergency Business Account loans.

A letter to the federal Finance Minister was signed by more than 240 Canadian business organizations. "Extending the repayment timeline for the CEBA loan without losing access to the forgivable portion would give many small-and-medium size businesses the stability and certainty they need to get back on their feet on a path to prosperity," states the letter. Chamber CEO Bruce Williams spoke to CFAX Radio this morning to explain why many businesses need extra time. Across Canada. almost 900,000 CEBA loans were approved during the pandemic. "Many businesses had no choice but to take on this loan due to circumstances beyond their control," the letter states. "This includes businesses in some of the hardest hit industries such as the retail industry and tourism sector. Mandatory business closures and other government health restrictions left businesses with severe income losses and cash flow issues." The Chamber has been working to advocate for investment and policy changes that make all of our communities safer. It's a complex issue that requires a major increase in resources to treat people struggling with mental health and addictions.

That said, we're please to hear that the federal government has proposed changes to Canada's bail system to keep violent repeat offenders off our streets. The shift comes after BC moved to use tools available to the province to address repeat offenders. "This is a start, but we need to address bottlenecks with our court systems and the length of time it takes to provide treatment for people who want help with mental health or addiction issues," Chamber CEO Bruce Williams said. "We don't have enough capacity in jails or treatment centres, and everyone requires a fair trial and can't be held on bail indefinitely." The Chamber will continue calling on all levels of government to ensure resources are available for the adequate enforcement of laws and bylaws, as well as investment in long-term solutions that address the root of the issues. Everyone needs to feel safe where they live and work. The fight against inflation is working as the Consumer Price Index for February was down 5.2% year over year. That compares to 5.9% in January and is the largest deceleration since April 2020. Lower costs at the pumps and for home energy helped lower the CPI, while the cost of groceries remains high as supply constraints and weather-related production issues is adding to the cost of food.

The global economy is getting back to normal but there's still a ways to go, says the Canadian Chamber of Commerce Chief Economist Stephen Tapp. "In this context, the latest Canadian Survey on Business Conditions shows that costs and labour issues remain the biggest near-term obstacles for Canadian companies," Tapp said the Q1 2023 Canadian Survey on Business Conditions Report. "Even as higher interest rates slow demand, there are a few bright spots. First, while long-standing supply-side bottlenecks for the workforce and supply chains remain elevated, they have eased in recent surveys. This might be because businesses are taking proactive steps to address these problems, such as raising wages, embracing flexible work options and working with suppliers. Second, while the near-term outlook for sales is clearly subdued, all things considered, most companies remain optimistic about the year ahead, especially larger firms and those in services." The court-imposed deadline for deciding the future of the Island rail corridor arrived yesterday, but there is still much work to be done to decide the fate of the former E&N Rail line.

"In September 2021, the British Columbia Court of Appeal asked the federal government to decide by March 14, 2023, on restoring the railway corridor or allowing a segment of lands to vest in Canada for the use and benefit of the Snaw-Naw-As First Nation," said a joint statement by the federal and provincial governments, explaining that the decision was made to return 11.4 acres to the Snaw-Naw-As. The corridor still has tremendous potential for Vancouver Island, which is expected to reach a population of more than one million people in the next decade. “To that end, we are committing $18 million to allow for future corridor planning involving affected First Nations and regional districts," BC Minister of Transportation and Infrastructure Rob Fleming said. "The funding will also allow First Nations to assess identified concerns such as flooding, access, noise, or safety issues where the corridor crosses their land." The Island Corridor Foundation had been waiting for the governments to announce their intention, and will now begin reviewing options for the best use of this important transportation link. A $204.8-million contract has been awarded for a major project that will see the Royal BC Museum build an important new facility in the City of Colwood.

Construction is expected to begin this summer on the museum's Collections and Research Building as part of a long-term plan to protect the Province’s collections, including more than seven million artifacts and the BC Archives. Total capital project costs for the building are valued at more than $270 million. The project is being undertaken in consultation with the Songhees Nation and Esquimalt Nation. The state-of-the-art facility will be 163,611 square feet and use mass timber construction to safely house the Province’s collections, BC Archives and research departments. There will also be dedicated research labs and learning spaces. “Alongside the safe and modern storage of the collections and provincial records, the (Collections and Research Building) will be a dynamic and welcoming community space,” RBCM CEO said Alicia Dubois said. “We hope to inspire future paleontologists, entomologists, botanists and historians through greater learning opportunities by enhancing public access to our work.” The new building will provide a secure location for a number of items that had been at risk, such as: archival books and manuscripts; rare and priceless artworks, including watercolours from the 1700s; several paintings by Emily Carr; and early provincial maps. |

Categories

All

|

Copyright © 2021 Greater Victoria Chamber of Commerce. All rights reserved.

#100 – 852 Fort St., Victoria, BC V8W 1H8, Canada | Phone: (250) 383-7191

[email protected] | Site Map

#100 – 852 Fort St., Victoria, BC V8W 1H8, Canada | Phone: (250) 383-7191

[email protected] | Site Map

Notice a typo or broken link? Please let us know so we can fix it ASAP. Email [email protected]