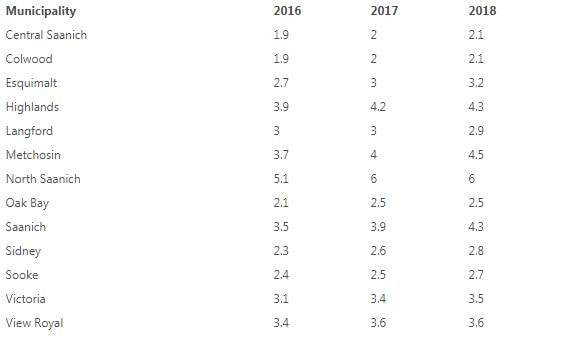

Catherine Holt, CEO Greater Victoria Chamber of Commerce By now, you’ve likely received your property tax notice with its visual aids and colourful graphs providing transparency about what your money is spent on. What isn’t transparent is the growing proportion of municipal taxes being dumped on business for no valid reason. All 13 of our municipalities charge businesses a much higher rate than they do residential property owners. From 2.1 times more in Central Saanich to six times more in North Saanich, businesses pay multiple times more than residents for property of the same value. A 2007 report by MMK Consulting for the City of Vancouver found that, on average, residential properties in Vancouver paid $0.56 in property taxes for each dollar of tax-supported services consumed, while non-residential properties paid $2.42 for every dollar of tax-supported services. That was 10 years ago but the gap has continued to grow in many B.C. municipalities. In Saanich this year, a business will pay 4.3 times more tax than a resident for a property of equal value. That’s up from 3.9 times more in 2017 and 3.5 the year before. That’s a disturbing trend and it’s not the exception — it’s the rule. The only municipality that has managed to lower its business ratio from 2017 is Langford. Even so, Langford businesses will pay 2.9 times as much as residential property owners in 2018. That’s down from three times as much in 2016 and 2017. Oak Bay, at a 2.5 ratio, and View Royal, at 3.6, deserve a nod for at least keeping their ratios the same as the previous year. Municipalities are struggling to keep up with increasing costs downloaded from higher levels of government — most recently the Employer’s Health Tax has been added to everyone’s load — it’s understandable why local politicians focus on keeping residential taxes down. Few issues get voters off the couch and into the ballot booth faster than a hit to their wallets. But, of course, business owners don’t have a vote. Many suspect more than a coincidence between the lack of vote and the rising share of taxes. However, dumping costs onto business is really just a diversionary tactic. Adding to the business tax burden means a business needs to earn more, which means it needs to charge more or find ways to cut costs. Residents who enjoy the products and services end up paying more or finding there are fewer options as businesses become priced out of their neighbourhoods. This is the reality that needs to be considered — especially when the public is faced with headlines, such as the one on the front page of the Times Colonist on May 24, proclaiming that Victoria residents are being treated unfairly because council is taking a bold step to rebalance the tax load. Victoria Coun. Chris Coleman explained to the Times Colonist that, without a redistribution, businesses would have been taxed at 3.69 times the residential rate. “To protect the residential component, we kept on increasing the business class,” Coleman says in the article. “It’s just we’ve been loading it on businesses over the years and they are seeing some stress as well. It’s always a balancing act between the classes.” Even with the redistribution, city businesses will still pay 3.5 times the residential rate, up from 3.4 last year and 3.1 in 2016. But Councillor Ben Isitt, also quoted in the article, didn’t support the redistribution because “business people ... have larger disposable incomes and are better positioned to absorb tax increases.” It appears that Isitt, despite his two terms on city council, has never actually met a business person in Victoria. The Chamber endorses Victoria Council’s decision and Langford’s choice to decrease the business rate. Last year, The Chamber sent a letter to all 13 municipal councils asking why businesses are taxed so much more, and requesting they close the gap. As this year’s tax rates show — with these two modest exceptions — the response is underwhelming. This isn’t good enough. Businesses create jobs, build our downtowns, support community organizations, drive our region’s economy and help provide solutions to serious challenges such as affordable, accessible housing and the need for better transportation systems. It’s time for all municipalities to stop dumping costs onto the backs of non-voting taxpayers. And to Coun. Isitt, on behalf of the businesses that pay more than their fair share to keep city hall in business, a little gratitude would go a long way. This column originally appeared in the Times Colonist on June 7, 2018 Ratio of Business to Residential Tax Rates

Comments are closed.

|

Archives

June 2024

Categories

All

|

Copyright © 2021 Greater Victoria Chamber of Commerce. All rights reserved.

#100 – 852 Fort St., Victoria, BC V8W 1H8, Canada | Phone: (250) 383-7191

[email protected] | Site Map

#100 – 852 Fort St., Victoria, BC V8W 1H8, Canada | Phone: (250) 383-7191

[email protected] | Site Map

Notice a typo or broken link? Please let us know so we can fix it ASAP. Email [email protected]

RSS Feed

RSS Feed